There are a handful of digital assets classes that have taken the spotlight as of late. Most notably, the newest cryptocurrency with RWA on Crypto and the integration of blockchain technology has become more and more prominent. In fact, the recent bitcoin ETF approval will only heighten the exposure and attention on cryptocurrency and blockchain projects.

Transformative Approach to RWA on Crypto & Blockchain

The tokenization of real-world assets with crypto (or RWA’s) has become relatively common – some examples include real estate property, United States Treasuries, precious metals, artwork or digitally any other physical asset. Prior to transitioning the discussion to AmmoCrypt and the unique value provided to holders, a brief overview of RWA on crypto blockchain as an asset class will be given.

Tokenized RWA on Crypto Are a Growing Asset Class

Real world assets are a growing asset class; in fact, it is the fastest growing asset class in decentralized finance (DeFi). According to research conducted by Galaxy, “Total value locked in RWAs has nearly doubled in 2023, growing from $1.44bn to $2.5bn as of September 30, 2023”. It’s no surprise that RWA on Crypto should continue to take the market by storm(big bull crypto) – the growth of market sizing in DeFi is showing no sign of slowing down.

With a recent couple of decades showing a significant shift towards new crypto currencies and away from traditional finance, it isn’t particularly surprising that decentralized finance, cryptocurrency and the tokenization of real-world assets have grown exponentially. From the perspective of a consumer, purchasing tokenized RWAs in crypto is simpler than purchasing the asset directly.

What are the Advantages of RWA on Crypto?

- No need to own, store or manage the actual physical asset

- Ability to purchase tokenized fragment of ownership of new RWA on crypto, rather than tying up the full value of the asset

- High-speed accessibility and liquidity through various digital marketplaces

These certainly aren’t the only advantages to purchasing tokenized RWA on blockchain – let’s talk about some examples of new crypto tokens in real world assets that traders have been buying into(similar to blackrock bitcoin etf).

Benefits of Tokenization of Assets Extends Beyond the Sphere of Real Estate

When considering the tokenization of real world assets on crypto, most individuals immediately leap to real estate and the tokenization of rental properties. Typically, consumers will purchase a portion of the overall property and will receive their equitable portion of any rental income and earnings from the property.

Unbeknownst to many, though, tokenized RWAs extend beyond just real estate – if you can own it as an asset, there is likely a tokenization that you can buy into for the digital asset.

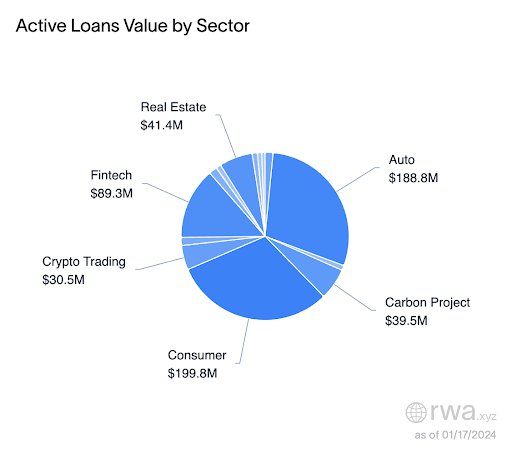

One of the more reliable RWA tracking and analytics websites, RWA.xyz, shows that tokenized assets range from private credit all the way to United States Treasuries. According to the data provided on their dashboard, the tokenized private credit market has over $500Mn of active loans and over $4.5Bn of total loans value. The tokenized Treasuries market is even larger, with the current active loans amount sitting at $862Mn – these two assets are just one of the many classes that individuals can own through tokenized RWAs.

By reviewing the information and data on TokenizedAssets.ai, users can sort through specific properties of new crypto tokens and debt vehicles that have been tokenized. For example, the “real estate” tab lists hundreds of real estate properties and their tokenization details. Users can purchase the beneficial tokens as a partial ownership of the property (or respective asset class) which they can later sell or trade at will. This makes RWA’s on the blockchain one of the best crypto to buy today.

What Differentiates AmmoCrypt from other on-chain Tokenized Real World Assets?

So, what separates AmmoCrypt from the rest of the tokenized real world assets on the crypto market? Most tokenized RWAs offer access to general or “normal” asset classes, tokenizing the property and making it more accessible. We do not focus on tokenizing existing debt or real estate assets; rather, we decided to innovate by targeting an otherwise “exotic” and difficult market to enter.

AmmoCrypt focuses on the benefits of tokenization through small arms ammunition, tapping into a market that is unique and is often difficult for outsiders. For many global traders, owning ammunition and firearms are illegal; this would essentially disqualify them from being able to purchase into the market entirely.

Beyond the real world reserves that we continue to build on crypto and provide, there are other external factors that make AmmoCrypt a potential disruptor.

Generally, the ammunition marketplace is plagued by supply and demand issues; suppliers typically have a pre-established production schedule that is based upon long-term government budgeting and procurement cycles. Production is allocated to the consumer market after making accommodation for planned government procurement demands. During periods of significant demand (usually when there are international conflicts or other governmental problems within a nation) there is often a spike in governmental demand, resulting in lack of availability for consumers.

By tokenizing ammunition, AmmoCrypt continues to build their reserve supply throughout periods of high and low supply through digital assets on blockchain. Holders of AmnoCrypt Kaliber Tokens will not face ammunition availability concerns during periods of heightened demand, as a benefit of tokenization with AmmoCrypt – they can simply convert their AmmoCrypt Kaliber Tokens for the respective ammunition held in our reserves.

Assuming you’ve passed the KYC process and meet the requirements for physical delivery, AmmoCrypt will redeem the tokens and then ship the ammunition to the user.

Ultimately, AmmoCrypt differentiates itself as a digital asset from other tokenized RWA on crypto and other blockchain projects through a few different measures. Being an ammunition’s tokenized ecosystem, we have targeted a market that goes through massive influxes and is often difficult for outsiders to participate in.

Sources:

https://www.rwa.xyz/blog/primer-on-real-world-assets

https://cointelegraph.com/learn/tokenized-real-world-assets-rwa-in-defi