Practical Guide: Step-by-Step Breakdown of Tokenization Process

In a world where digital innovation meets traditional markets, the concept of digital asset with benefits of tokenization stands out as a revolutionary force, especially in sectors like the global ammunition trade. With an estimated market size of $68.57 billion in 2023 and growing, the ammunition industry faces unique challenges and opportunities, particularly in the realm of supply chain management and investment.

Crypto token, particularly through platforms like AmmoCrypt, offers a compelling solution to these challenges, leveraging blockchain technology to bring clarity, efficiency, and expanded access to this critical market. Let’s start with what is a tokenization.

Let’s learn what is tokenization?

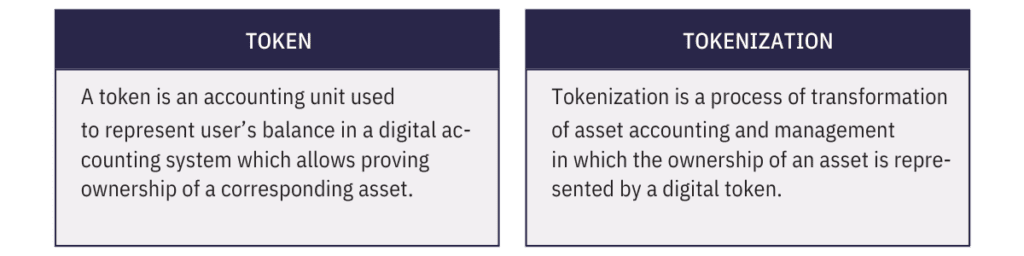

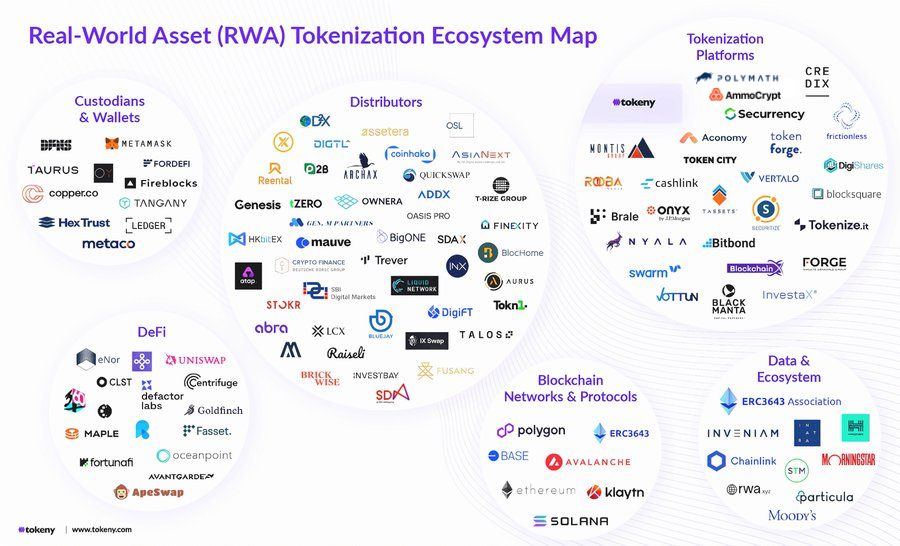

At its core, tokenization involves converting rights to an asset into a digital token on a blockchain. These tokens can represent real-world assets (RWA), from artwork and real estate asset tokenization to, more innovatively, ammunition. This process offers a secure, transparent, and efficient way of managing and trading assets, opening new doors for investors and industry stakeholders alike. Below we are delving into the RWA meaning.

Source: TokenD white paper by Distributed Lab

“Tokenization provides a streamlined peer to peer marketplace for “virtualized” physical assets. It is no different conceptually [from] contracts (such as gold contracts). The primary difference lies in the lack (in an ideal case) of middlemen, brokers, underwriters, clearance and settlement houses, etc.

Once a protocol (the software behind tokenization) has implemented a legally viable tokenization system, asset holders can use the protocol to virtualize their assets and offer them for sale on token marketplaces such as Uniswap and Binance,” – Marco Aniballi, executive and board member at Emerging Technology Association (ETA).

According to Mr. Aniballi, Mattereum emerged as a pioneering force by establishing the legal framework for what is tokenizing tangible assets across different legal systems. Additionally, new protocols on Ethereum are being developed to facilitate the fractional ownership of substantial NFT assets without generating a distinct token.

As a benefit, tokenized asset is a permanent cryptographic depiction of a contract that bestows ownership of a physical asset. This tokenized asset can be exchanged between parties instantly, eliminating the need for involvement or oversight from institutions, regulators, or legal bodies.

How does tokenization of real world assets work?

Here’s a simplified guide on how to tokenize an asset:

- Asset Selection: The first step is selecting a real-world asset for tokenization, such as commercial properties, residential real estate, artwork, or precious metals.

- Legal and Regulatory Compliance: Compliance with local laws, securities regulations, and property rights is essential for tokenization projects. Smart contracts on blockchain are often used to ensure compliance with ownership rules.

- Asset Valuation: Appraisers or experts assess the asset’s value to determine the number of tokens to be issued and their initial value and benefits of token.

- Token Creation: Tokens representing ownership or rights to the asset are created on a blockchain. These tokens can be fungible (identical and interchangeable) or non-fungible (unique and non-interchangeable).

- Ownership Distribution: Tokens are distributed to investors or buyers in exchange for cryptocurrency or fiat currency. Each token represents a fraction of ownership in the underlying asset.

- Smart Contracts: Smart contracts automate processes such as rental income distribution, dividend payments, or voting rights associated with the digital asset and and benefits of token..

The technical specifications for each platform vary significantly, says Amanjyot Johar – Strategic Tech Advisor, Principal at Proteum Capital. For they must adhere to the laws and regulations of both the platform’s location and the jurisdictions where the RWAs are traded. It can be implemented using ERC20, ERC721/1155 standards, or a mix of both.

Additionally, the expert says the technical considerations include asset custody and how the marketplace operates. Non-custodial approaches may face challenges due to user inconvenience. Ethereum Virtual Machine (EVM) compatible chains are recommended for their benefits in interoperability and liquidity.

Ben Forman, the managing partner at ParaFi Capital, offers deep insights into the transformative journey of Real World Asset (RWA) on crypto and benefits on tokenization, cornerstone of blockchain projects like the much-discussed Blackrock Bitcoin ETF. This enthusiasm is fueled by the potential of crypto tokenization within the blockchain domain, which many consider the next bull run in crypto. With institutional giants such as JPMorgan, Invesco, and KKR showing interest, the scope for RWA tokenization expands, moving beyond financial assets to include non-financial assets, making it a prime candidate for the best crypto to buy today.

Source: Binance Research report

These assets, ranging from the tokenization of vehicle titles by the California Department of Motor Vehicles to digital settlement assets like university diplomas, tokenized shares and concert tickets, represent a new frontier for asset tokenization platforms. This expansion aligns with the growing trend of innovative blockchain projects and newly added cryptocurrencies, aiming to redefine investment strategies in the digital age.

Reasons behind growth of RWAs

Why is RWA tokenization gaining popularity and its benefits?

- Increased Liquidity: Tokenization allows for fractional ownership, making high-value assets accessible to a broader range of investors. This increased liquidity can facilitate quicker asset sales and transactions.

- Fractional Ownership: Asset tokenization companies enable investors to diversify their portfolios by holding fractional ownership in multiple assets, mitigating risk.

- Lower Barriers to Entry: Traditional real estate investments often require substantial capital. Tokenization reduces these barriers, enabling smaller investors to participate in lucrative real estate markets.

- Transparency and Security: Blockchain tokenization provides transparency by recording all transactions on a tamper-resistant ledger, enhancing trust and security for investors.

- Global Accessibility: Blockchain technology enables global token investment in RWAs. Investors from different countries can easily buy and trade tokens, expanding the pool of potential investors.

- 24/7 Trading: Blockchain-based markets operate 24/7, unlike traditional markets with operating hours, allowing investors to trade tokens anytime.

- Efficiency: Tokenization companies can streamline processes such as property management, rent collection, and dividend distribution through smart contracts, reducing administrative costs and potential disputes.

- Compliance and Automation: Asset tokenization platforms can integrate compliance rules into smart contracts, automating regulatory compliance and ensuring that transactions comply with local laws.

Source: TokenD white paper by Distributed Lab

Furthermore, Forman explores the use of blockchain for monetizing YouTube content creators’ future cash flows, a model that resonates with which crypto to buy today for long-term. This innovative approach showcases how blockchain technology can serve as a robust platform for tokenizing RWAs, offering transparency and efficiency in transactions. The narrative underscores the importance of asset tokenization companies in facilitating these advancements, with projects like AmmoCrypt leading the way in RWA tokenization for ammunition.

This reflects a significant shift towards digital asset tokenization, emphasizing how blockchain technology is becoming an essential tool for redefining asset ownership and investment token, particularly in the context of real-world assets crypto transformation.

The Rise of AmmoCrypt: A Case Study in Innovation

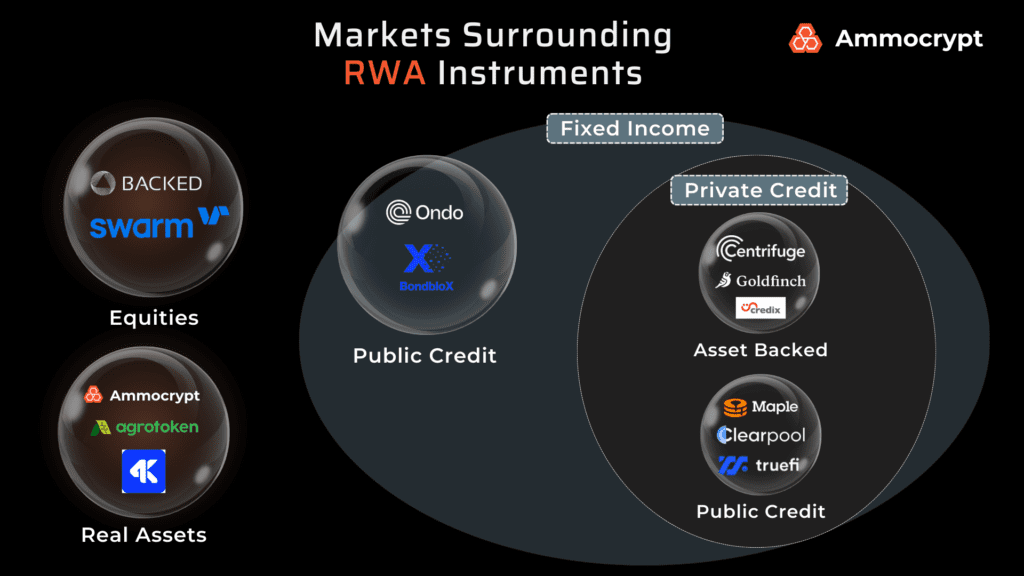

AmmoCrypt emerged as a pioneering force in the tokenization of real-world assets, focusing on the ammunition sector. By introducing a dual-token system (comprising of “Kaliber” tokens for asset-backed ammunition representation and “YEET” tokens for operational functions), AmmoCrypt not only addresses but also capitalizes on the increasing demand for small arms ammunition, fueled by geopolitical conflicts and the rising popularity of shooting sports as a benefit of tokenization.

Impact on the Supply Chain

The traditional ammunition supply chain is fraught with inefficiencies, from manufacturing delays to regulatory bottlenecks. AmmoCrypt’s tokenized solution proposes a radical simplification, allowing for direct trade of ammunition through digital representations. This not only streamlines the supply chain but also offers a layer of resilience against disruptions, ensuring that demand can be met more reliably and transparently.

Broadening Investor Access

One of AmmoCrypt’s standout contributions is how it democratizes access to the ammunition market. Traditionally, investment in this sector has been limited to those with significant resources and industry knowledge. Digital asset tokenization opens the market to a broader range of investors, allowing for fractional ownership, liquidity, and a level of accessibility previously unimaginable. This is particularly relevant in light of the recent bitcoin ETF approval and the interest in blockchain projects and asset tokenization platforms.

Ensuring Compliance and Security

Compliance and security are paramount in a regulated and sensitive market as ammunition. AmmoCrypt’s platform is designed with these priorities in mind, ensuring that transactions comply with financial and arms control regulations. The blockchain tokenization process also offers an added layer of security against illicit trade, providing a transparent ledger of asset ownership and movement.

The Future of Investment: Benefits of Tokenization and Beyond

As we stand on the brink of the next big crypto movement , with projects like AmmoCrypt leading the way, the potential for tokenization and its benefits extends far beyond ammunition. The principles of how to invest in tokenization and technology underpinning AmmoCrypt’s platform could revolutionize how we think about and interact with RWAs across industries. From reducing barriers to entry and enhancing liquidity to ensuring security and compliance, the benefits of tokenization of real world assets are vast and varied.

Final thoughts

The intersection of blockchain technology and traditional markets like ammunition is just beginning to reveal its potential to define tokenization. With platforms like AmmoCrypt pioneering the way, the future of investment, supply chain management, and industry innovation looks brighter than ever. As we navigate this evolving landscape, the key will be in leveraging these technologies to create more efficient, accessible, and secure markets for all stakeholders involved.

Sources

A Transformative Approach to RWA

Newly Launched Blockchain-based Projects to Follow in 2024

https://www.linkedin.com/feed/update/urn:li:activity:7131269060205371392/